Import Setoffs

The Import Setoffs - imports all debtors who were setoff by the N. C. Department of Revenue and/or Education Lottery. This process should be executed as soon as possible after receiving an email from the Clearinghouse stating "A Setoff File was processed by the Department of Revenue or Education Lottery" .

Frequency - whenever a notification of a setoff file is received via email from the Clearinghouse. There is normally twenty-two to twenty-three setoff files per year. If the local government did not have any setoffs they will not receive and email.

These files are usually available the 1st and 3rd Fridays from February through May. From June through December the files are available by Thursday and sometimes even by Wednesday.

- this menu requires only Transmit = 'Yes' access rights assigned in the User Setup. With this access right the User can import the setoff file. This function will download and apply ALL setoffs in the file, regardless of the Account Code/Departments. Even if the User does not have access rights to all Account Codes/Departments.

- this menu requires only Transmit = 'Yes' access rights assigned in the User Setup. With this access right the User can import the setoff file. This function will download and apply ALL setoffs in the file, regardless of the Account Code/Departments. Even if the User does not have access rights to all Account Codes/Departments.

- the setoff file is only available for 10 days before it is automatically deleted. However, it can be restored by contacting the Clearinghouse.

- the setoff file is only available for 10 days before it is automatically deleted. However, it can be restored by contacting the Clearinghouse.

The Clearinghouse sends email reminders if the setoff file was not downloaded within seven days. if still not downloaded within nine days the Clearinghouse will call the Debt Setoff Coordinator.

Once the setoff file has been imported and processed be sure to do a Transmit-Export to Clearinghouse-Debtor Information which will initiate an Import Status report the following Monday or Tuesday.

What happens if the local government does not download their setoff file? When the local government does a Transmit-Export to Clearinghouse-Debtor Information it will restore the debt to the amount prior to the setoff. So if the debtor files another tax refund it will setoff their refund again thus requiring the local government to refund the probably upset debtor.

- there are several other files that may be available in the secure folder along with the setoff file. It is strongly suggested that these files be downloaded and saved by the local government. We suggest renaming the file(s) with the setoff date. Ex.: Surplus-Feb1-2012.xlsx

- there are several other files that may be available in the secure folder along with the setoff file. It is strongly suggested that these files be downloaded and saved by the local government. We suggest renaming the file(s) with the setoff date. Ex.: Surplus-Feb1-2012.xlsx

These files are:

- Cnnn.xlsx (County or Agency)or Mnnn.xlsx (Municipality) - this Excel file contains all debtors and debts that were setoff. nnn is the assigned agency code.

- SSN

- Name (from the Department of Revenue)

- Address (from the Department of Revenue)

- Debt Amount after Setoff

- Setoff Amount

- Setoff Date

- Account Number

- Department

- Unique ID

- Prior Names Tax Refunds Filed (from the Department of Revenue)

- Surplus.xlsx - this Excel file contains debtors that the Clearinghouse believes may be over payments which need to be returned to the taxpayer. We recommend research be done BEFORE sending a refund. If a refund is due, this Excel file provides valuable information:

- SSN

- Name

- Address (from the Department of Revenue)

- Setoff Amount

- Surplus Amount (as Clearinghouse calculates, but still verify)

- Clearinghouse Fee

- Department

Processing Instructions:

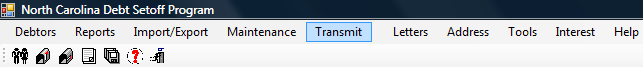

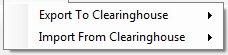

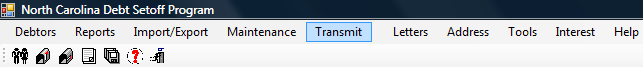

1. From the Main Menu click Transmit:

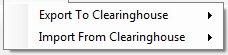

There are two functions within Transmit:

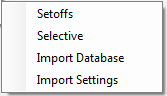

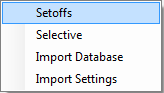

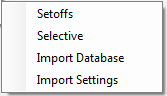

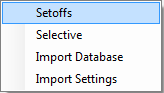

2. Move the mouse over the Import from Clearinghousefunction to view the four options:

3. Move the mouse over Setoffs and click this option:

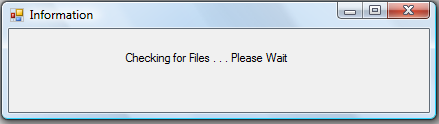

4. The following screen appears:

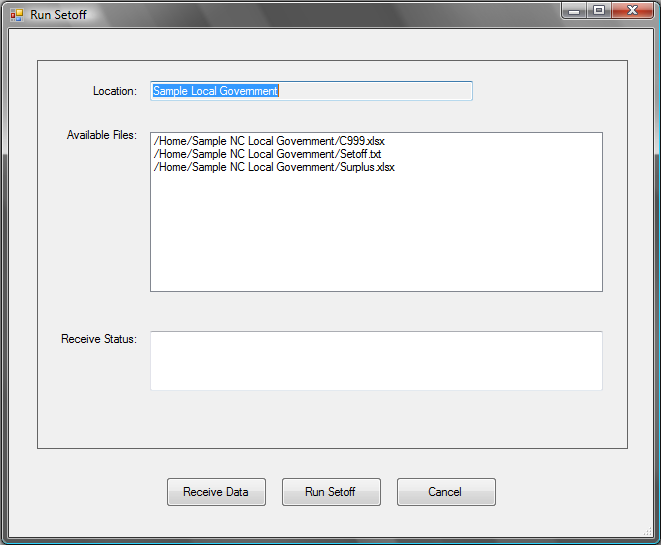

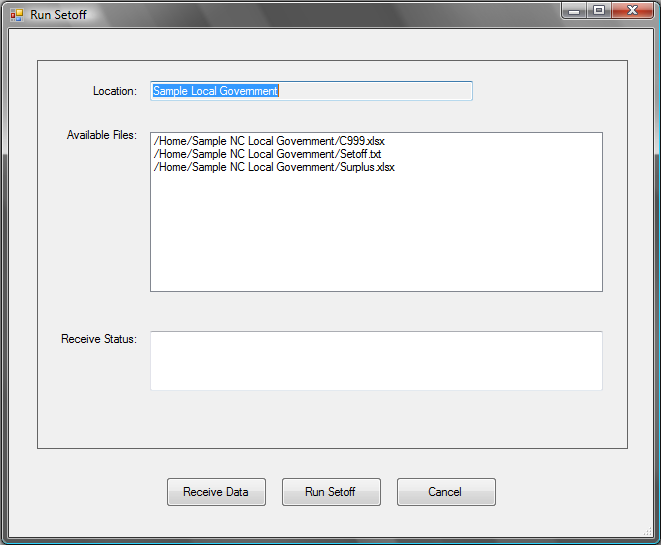

5. All available files available appear:

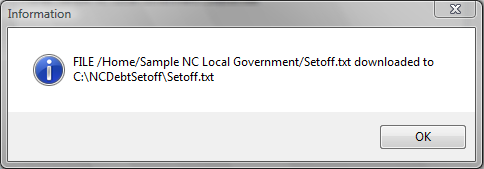

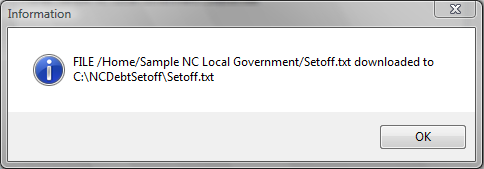

6.Click  to begin the download, when completed the following appears:

to begin the download, when completed the following appears:

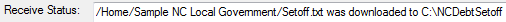

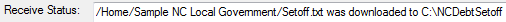

7. Click  and the file name and location appear in the Receive Status:

and the file name and location appear in the Receive Status:

8. Click  to begin the process, when complete, the following appears:

to begin the process, when complete, the following appears:

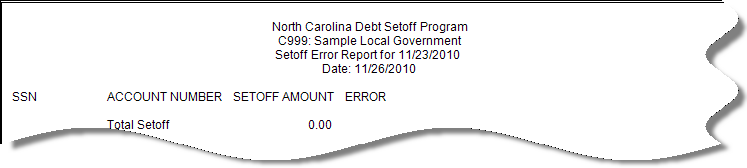

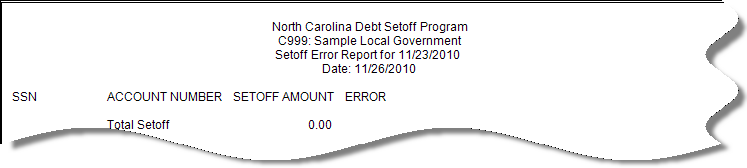

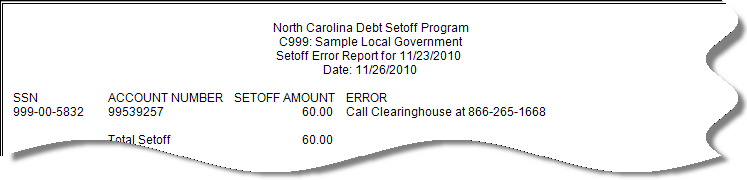

9. The 1st report: the Setoff Error Report appears:

- if there are no errors, then the report is empty and shows $0.00 in error:

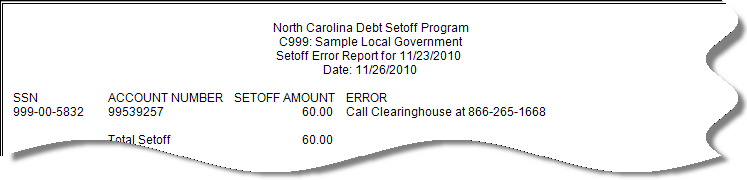

- An example of an error report, that would need Clearinghouse attention:

- Contact the Clearinghouse immediately as this setoff could not find the SSN and Unique Key. The most probable reason is that the debt, or even the debtor, was deleted rather than the debt changed to $0.00. The Clearinghouse recommends debts and debtors not be deleted until after the last setoff file in December.

- Contact the Clearinghouse immediately as this setoff could not find the SSN and Unique Key. The most probable reason is that the debt, or even the debtor, was deleted rather than the debt changed to $0.00. The Clearinghouse recommends debts and debtors not be deleted until after the last setoff file in December.

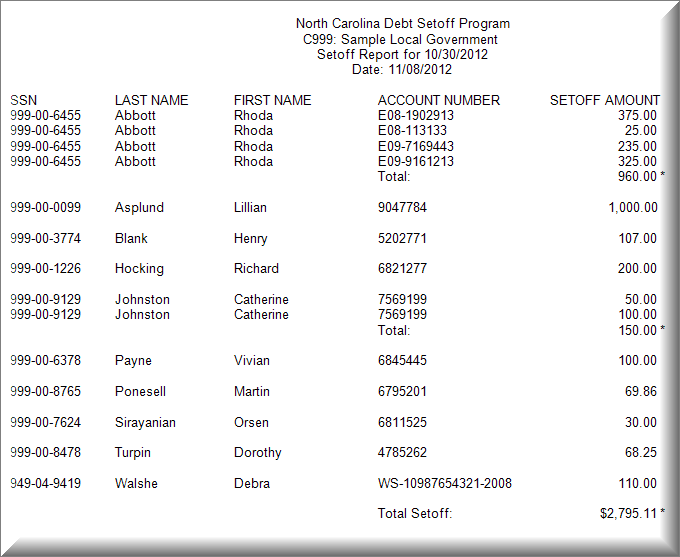

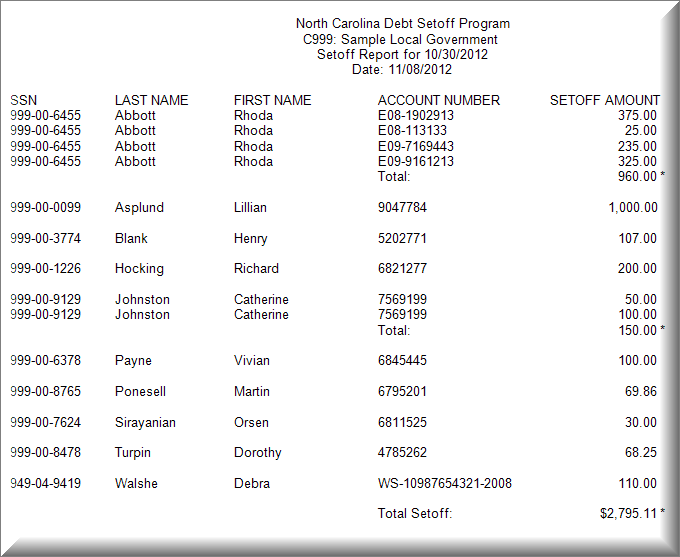

10. The 2nd Report: Setoff Report appears:

11. Click  to print the report

to print the report

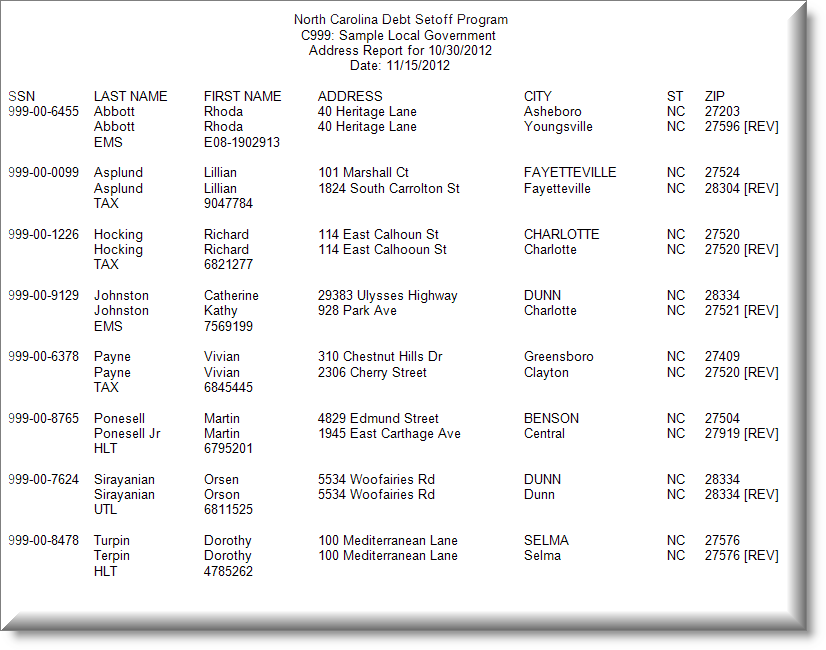

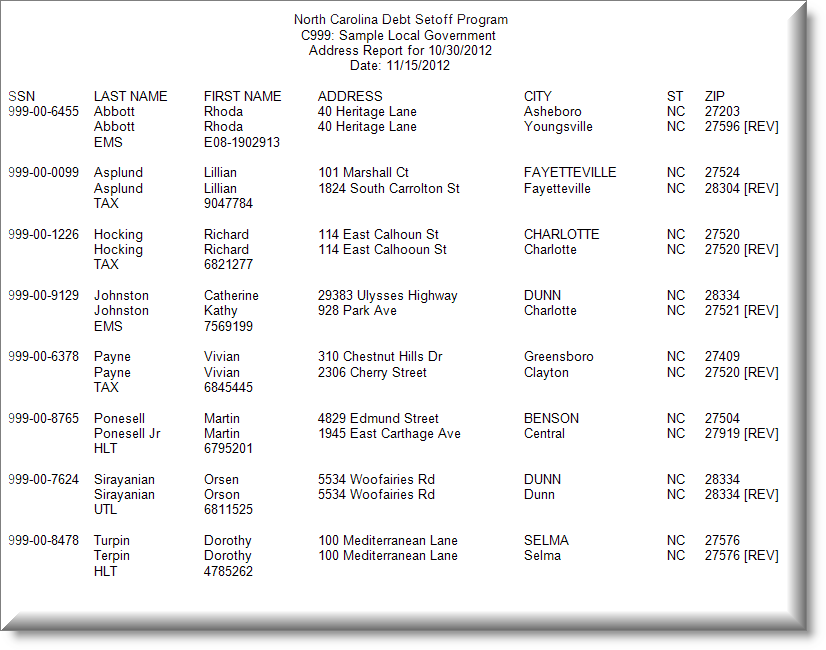

12. Click  for the 3rd Report: Address Exception Report:

for the 3rd Report: Address Exception Report:

- If there are any differences in Last Name, First name, Address, City, State or Zip

- If no differences appear it is probably the result of a Zip+4 which does not show because of space on the Report

- 1st line is the name and address information in the local government database

- 2nd line is the name and address information from the N. C. Department of Revenue and has

at the end of the line

at the end of the line

- 3rd line has the Account Code and Account Number for the debt that was setoff

13. Click  to print the report, if desired.

to print the report, if desired.

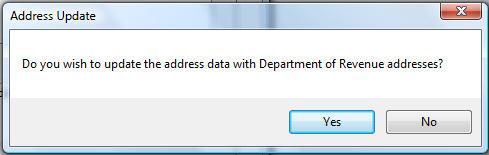

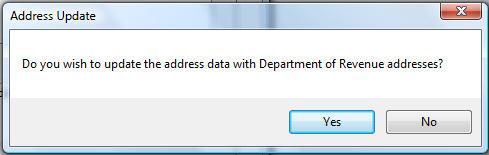

14. Click  for the following prompt:

for the following prompt:

- Click

to skip the update of the Department of Revenue's address information to the software

to skip the update of the Department of Revenue's address information to the software

- Click

to apply the Department of Revenue's address information to the software

to apply the Department of Revenue's address information to the software

- if applying the Department of Revenue's addresses, ALL will be updated, it will not allow only certain ones to be updated. If you do not want to update all, use the report and manually apply only the ones desired. The address exceptions will be retained and can be printed or applied all at once and then purged once done. These can be printed, applied and purged through the option

- if applying the Department of Revenue's addresses, ALL will be updated, it will not allow only certain ones to be updated. If you do not want to update all, use the report and manually apply only the ones desired. The address exceptions will be retained and can be printed or applied all at once and then purged once done. These can be printed, applied and purged through the option

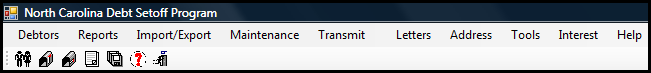

15. Return to the main menu:

- this menu requires only Transmit = 'Yes' access rights assigned in the User Setup. With this access right the User can import the setoff file. This function will download and apply ALL setoffs in the file, regardless of the Account Code/Departments. Even if the User does not have access rights to all Account Codes/Departments.

- this menu requires only Transmit = 'Yes' access rights assigned in the User Setup. With this access right the User can import the setoff file. This function will download and apply ALL setoffs in the file, regardless of the Account Code/Departments. Even if the User does not have access rights to all Account Codes/Departments.  - the setoff file is only available for 10 days before it is automatically deleted. However, it can be restored by contacting the

- the setoff file is only available for 10 days before it is automatically deleted. However, it can be restored by contacting the  - there are several other files that may be available in the secure folder along with the setoff file. It is strongly suggested that these files be downloaded and saved by the local government. We suggest renaming the file(s) with the setoff date. Ex.: Surplus-Feb1-2012.xlsx

- there are several other files that may be available in the secure folder along with the setoff file. It is strongly suggested that these files be downloaded and saved by the local government. We suggest renaming the file(s) with the setoff date. Ex.: Surplus-Feb1-2012.xlsx

to begin the download, when completed the following appears:

to begin the download, when completed the following appears:

and the file name and location appear in the Receive Status:

and the file name and location appear in the Receive Status:

to begin the process, when complete, the following appears:

to begin the process, when complete, the following appears:

- Contact the Clearinghouse immediately as this setoff could not find the SSN and Unique Key. The most probable reason is that the debt, or even the debtor, was deleted rather than the debt changed to $0.00. The Clearinghouse recommends debts and debtors not be deleted until after the last setoff file in December.

- Contact the Clearinghouse immediately as this setoff could not find the SSN and Unique Key. The most probable reason is that the debt, or even the debtor, was deleted rather than the debt changed to $0.00. The Clearinghouse recommends debts and debtors not be deleted until after the last setoff file in December.

for the 3rd Report: Address Exception Report:

for the 3rd Report: Address Exception Report:

at the end of the line

at the end of the line

to skip the update of the Department of Revenue's address information to the software

to skip the update of the Department of Revenue's address information to the software to apply the Department of Revenue's address information to the software

to apply the Department of Revenue's address information to the software